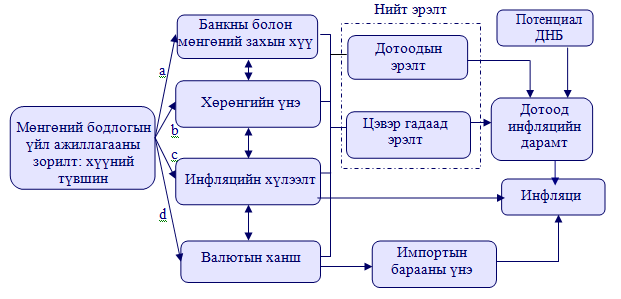

Monetary operations are being implemented and reach its final objectives through the monetary policy transmission mechanism. In other words, the monetary policy transmission mechanism represents what type of channels the changes in monetary policy instruments pass through to influence the policy’s final objectives. Such transmission mechanism is often used in implementing inflation-targeting framework of monetary policy. The interest rate, asset prices, inflation expectation and exchange rate channels of monetary policy transmission mechanism are depicted in Graph 2.

The change in policy instruments affect the banking and finance market interest rate level (mortgage and savings rate), public expectation regarding economic outlook, asset prices and exchange rate; thus individual and corporate spending, savings and investment decisions through its operational objectives. For example, an increase in interest rate will provide an incentive to consumers to save rather than to spend with other factors remaining constant. Moreover, an appreciation of local currency on the foreign exchange market will cause goods produced abroad to be relatively cheap and affect demand for goods and services produced locally. Demand and supply ratio (in the case of labour market and other markets) influences domestic inflationary pressures. In the event of labour shortage, firms increase their prices to reflect the additional cost of wage increase and as a result, inflation may rise. A movement in exchange rate affects inflation directly and indirectly. It affects inflation directly by influencing the price of imported goods and services, while it has an indirect effect on inflation by influencing the amount of domestic export and import or net external demand.

Click here to view SIMOM /Small Inflation Model of Mongolia/ which is a widely-used model by the Bank of Mongolia in monetary policy decision making.