Price stability is the long-term main objective of monetary policy

The role of money is critical in effective functioning of economic activities. Within its main objective of monetary policy, Bank of Mongolia shall promote balanced and sustained development of the national economy through maintaining the stability of national currency, the togrog, and keeping inflation at sustained low level.

The objective of ensuring sustained low levels of inflation (regarded as the concept of price stability) will lead to a wide range of objectives that are aimed at bringing the country to its sustainable economic growth path.

In truth, the main contribution of the Central bank for the country’s growth and development is to facilitate the formation of public trust in their future by creating expectations of sustained price level. Such price stability provides an incentive to gain from savings, investment and productivity which are essential to economic growth. In addition, sustained low levels of inflation positively influence allocation of income. This is because employment level rises and real income earned by vulnerable part of society is maintained due to sustained low inflation.

Long-run money neutrality

Price stability is the only way that monetary policy can influence the long-term economic growth.

By increasing money supply in the short-run, it causes output to rise and unemployment rate to decline. However in the long-run, an increase in wages and price level do not have any impact on the output level and the unemployment rate.

The principle of changes in money supply causing only price increases in the long-run is known as "money neutrality". In the long-run, real income and employment rates are determined by factors such as, technological advancements and population growth.

Central bank pursues policies in the short run that mitigate the negative effects of economic cycle or avoid from unexpected swings in the domestic demand that cause financial market instability, economic recession and increased unemployment. Central bank solely has the right to supply currency in circulation. In terms of having the monopoly power to supply reserve money, the Central bank is able to influence the money market interest rates or rates of lending and borrowing among banks by determining the conditions for loans given to commercial banks.

Central bank tries to influence the money market rate, thus output and price level, when aggregate demand goes up and down sharply. This complicated process is called the monetary policy transmission mechanism; whereby its short run influences on GDP and employment are dependent upon the channels of transmission mechanism.

Therefore, the main objective of monetary policy is concerned with maintaining price stability in the long-run by taking into account of short run influences on the economy and employment rate.

Inflation is a monetary phenomenon

As mentioned above, price stability is the only way that monetary policy can influence the long-term economic growth. Central bank is not able to sustain long-term economic growth by expanding money supply or lowering short term rate excessively compared to inflation rate. Central bank is able to affect only the general price level.

All in all, inflation is a monetary phenomenon. High inflation level is mostly connected with oversupply of money in the economy. Although factors such as aggregate demand, technology changes, and decline in goods’ prices can influence inflation, such influence can be neutralized by monetary policy after certain periods.

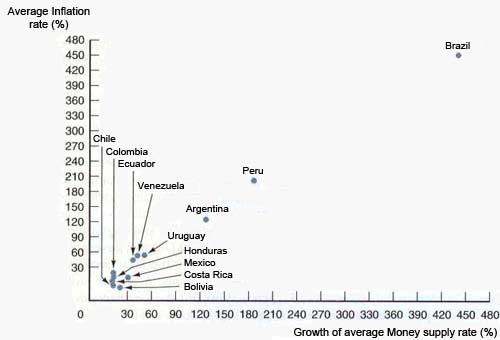

The inflation and money supply growth of Latin American countries, 1989-1999

Source: IFS